There are many reasons for the lack of charitable giving in people’s estate plans, but a lack of charitable intent is not one of them. Consider the following example:

-

John Smith is a widower in his 70’s with three children who are all on successful career paths.

-

Mr. Smith has never been a high income earner, but he has avoided debt.

- He has always been generous, giving small annual gifts to his favorite charities.

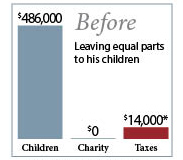

- His estate is worth approximately $500,000, including $50,000 in an IRA.

- Mr. Smith was not aware that his children will have to pay income tax when they receive a distribution from his IRA.

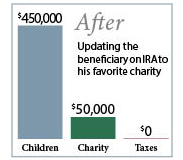

- By making one simple change to his estate plan (redirecting his IRA to charity), Mr. Smith will potentially make a larger gift to his favorite charity than he ever dreamed possible.

- He will have accomplished this while reducing his children’s inheritance by less than 7.5%.

- He will eliminate the government as a significant beneficiary of his estate.

- The updated plan reflects his values. Every single dollar of his estate will go to benefit someone or some cause that he loves, and not a single dollar is lost to taxes.

United Church Homes is pleased to offer our friends and supporters a values-based estate planning service from an expert estate planning advisor. Paul Grassmann of Thompson & Associates visits Ohio monthly to meet with and assist families or individuals as they navigate through various practical, emotional, and legal issues.

If you are interested in learning

more about this complimentary service, or in scheduling an appointment with Paul,

please contact Gloria Hurwitz,vice president of advancement,

at ghurwitz@uchinc.org

or 740.751.8702.

###