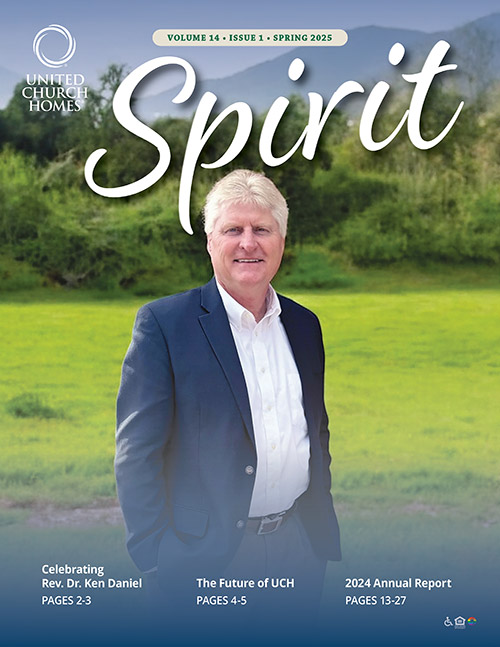

By Paul Grassmann, JD, FCEP

Paul Grassmann, JD, FCEP, Thompson & Associates

Thompson & Associates

This year, we saw major changes in the estate planning arena that will impact almost everyone. The Setting Every Community Up for Retirement Enhancement Act of 2019, better known as the SECURE Act, became effective Jan. 1. It effectively eliminated the Stretch IRA – the ability to take required distributions from an inherited retirement account over the beneficiaries’ life expectancies.

Now nonspousal beneficiaries are required, with limited exceptions, to liquidate the inherited funds within 10 years. This can create significant planning quandaries for those who desire to control these funds beyond a 10-year window, or simply desire further tax-deferred growth on these funds for their families. While there are still trusts that can hold and secure retirement assets beyond the 10-year liquidation period, income over $12,950 retained in trust is taxed at 37 percent, the highest federal rate.

IRA Charitable Rollover

For those who have already set up outright gifts or are considering making them, ensuring these gifts come first from retirement assets is now more important than ever.

Charitable planning provides another option with good solutions. This can be done, through the IRA Charitable Rollover, after age 70 ½ or as a beneficiary designation on the retirement account. Most people view their charitable actions as a pure gift,

with no thought of a personal benefit. In fact, there are numerous ways you can structure these gifts to create charitable impact and provide for your family.

For instance, a Charitable Remainder Trust (CRT) doubles under the SECURE Act the amount of time retirement funds can remain invested tax-free from 10 to 20 years. In certain situations, the funds can remain in the trust throughout the beneficiary’s

lifetime. During the trust term, the trust will typically pay out to your heirs. At the end of the term, the remainder can be given to the charity you choose.

A CRT can result in a small decrease for heirs, but it also allows for a structured payout over a long period of time for heirs while creating a significant charitable gift. In some situations, when the beneficiary’s tax rate or the trust tax rates are considered, your beneficiaries might receive more through the CRT than with noncharitable options.

Complimentary Estate Planning

Gloria Hurwitz, CFRE, Vice President of Advancement

If you would like to learn more about making a contribution to United Church Homes from your IRA, please contact Gloria Hurwitz, vice president of advancement, at [email protected] or 740.751.8702. Additionally, to review how the SECURE Act impacts your planning, please consider taking advantage of a complimentary, values-based estate planning process that United Church Homes is making available to you. Contact Gloria to learn more.

Gift planning is complex, and everyone’s situation is unique. The scenarios described here are not to be interpreted as legal or tax advice and everyone should seek the counsel of a licensed attorney or tax adviser before attempting to implement any strategy.

View all articles by: